Do you use Ulster Bank for Invoice Discounting?

It's time to switch

Only 6 months left before Ulster Bank leave the Irish Market.

With InvoiceFair there are no debtor or geographic concentration limits. Which means we can release up to 90% of your Debtor Book. Plus we’ll fund up to 40% of your WIP on top of that. Which means you can expect to release far more funding than you did with Ulster Bank.

With no Personal Guarantees required, isn’t it time you made the switch?

ACCESS UP TO 90% OF YOUR DEBTOR BOOK & 40% OF YOUR WIP IMMEDIATELY!

Leave your details below and one of our team will explain how it will work for you.

or call our team of experts now on

How much could you raise in 24 hours?

Looking for growth funding but getting frustrated with traditional financial providers? We’ll advance you up to 90% of your entire Debtor Book and as much as 40% of current Work in Progress within 24 hours of approval.

Who is it suitable for?

Limited Company with at least 2 Directors

Registered in an OECD Country

Trading for at least 36 months

Minimum annual turnover of €3m

Debtors located in OECD countries

You could raise

€0

every month for just

€0

This is just an indicative cost. Get an accurate quote now

Benefits of Innovative Invoice Discounting

No Debtor

concentration limits

Release more funds from your Debtor Book

Global

No Geographic limitations

WIP Funded

Confidence to tender for contracts with claims and WIP funding

No PG’s

No personal guarantees required

Speed

Funds within 24 hours

No Hidden Costs

No hidden costs or nonutilization fees

Control

You decide how much of your Debtor Book or WIP you want to trade

Confidential

Our relationship is not disclosed to your debtors

No FX Risk

Multi-Currency funding

Simple

Intuitive, easy to use platform

What is Innovative Invoice Discounting?

Companies are struggling to access funding on their terms to help grow their business. Traditional forms of business funding are severely restrictive and are not designed to allow them control their own future. How much faster would your business grow if you could access the capital tied up in your debtor book and WIP right now without resorting to additional debt or diluting your equity?

Our Innovative Invoice Discounting solution is unique – there are no Debtor concentration limits, geographic restrictions or hidden or non-utilisation fees. We even fund your Work in Progress! It allows you to take control, react to market opportunities and grow faster without restriction.

The cost of finance is agreed in advance, and you control when and how much you need to draw down.

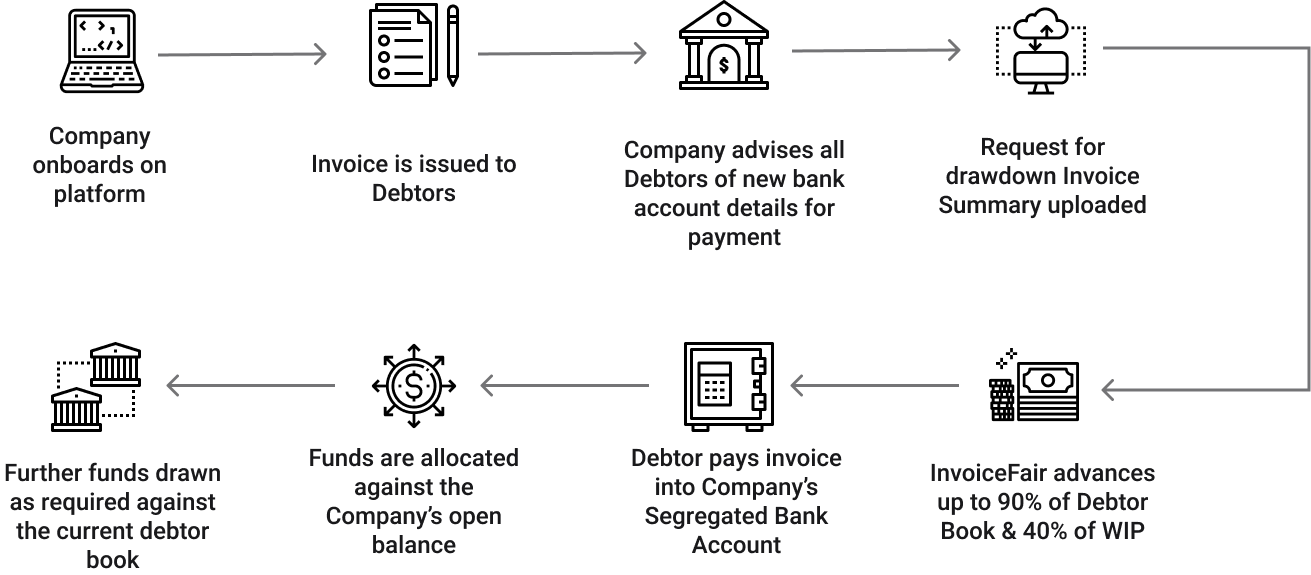

How it Works

€1BN

in Funds Advanced

€3BN

Assets under Management

250

Companies funded

Innovative Invoice Discounting vs. Traditional Banks

| Details | Invoice Fair | Traditional Banks |

|---|---|---|

| Customer Concentration Limits | No | Yes |

| Geographic Restriction Limits | No | Yes |

| Invoice % Funded | 90% | 70-85% |

| Sector restrictions | No | Yes |

| WIP Funding Available | Yes | No |

| Contract Period | Yes | Yes |

| Arrangement Fee | Yes | Yes |

| Minimum Monthly Fee | Yes | Yes |

| Disclosure fee (for breach of agreement) | No | Yes |

| Discounting Fee | Yes | Yes |

| Electronic services fee | No | Yes |

| Collections fee | No | Yes |

| Drawdown Cost - Same | No | Yes |

| Drawdown Cost - 3 day | No | Yes |

| Annual Audit Fee per site | No | Yes |

| Director Guarantee | No | Yes |

FAQs

How do I get funded?

There are 6 simple steps to get growth funding from InvoiceFair

1. Sign up and create an account

2. Securely connect your financial integrations (accounting & banking)

3. Provide the requested financial information to InvoiceFair

4. Should you meet our funders requirements, we will issue a Term Sheet for completion and security will be put in place over your company

5. Get your debtors to pay into an account in your name that is controlled by InvoiceFair

6. Upload trade to the InvoiceFair platform and get funding

How long does it take to get Funding with InvoiceFair?

You can sign up and request funding in less than 5 minutes. Our team will then be in touch within 24 hours to discuss your needs.

This ensures we generate offers tailored to you.

Once you’re happy with an offer, a formalised offer will be with you within 5 business days and you can start the security registration process.

When onboarding is complete, funding will be within your account within 24 hours of you requesting a drawdown

This ensures we generate offers tailored to you.

Once you’re happy with an offer, a formalised offer will be with you within 5 business days and you can start the security registration process.

When onboarding is complete, funding will be within your account within 24 hours of you requesting a drawdown

How much funding can I get from InvoiceFair?

We can provide from €5m-€50m in annual funding on the basis your company is eligible for same.

Each company is assessed on a case by case basis so once you sign up, provide information and connect your accounting/banking accounts, we will create the best offer tailored for you.

Each company is assessed on a case by case basis so once you sign up, provide information and connect your accounting/banking accounts, we will create the best offer tailored for you.

Are there any restrictions on this type of funding?

You will need to have assets to sell i.e debtor receivables and we will want companies with an average debtor book of €500k per month.

Generally, companies are required to create a track record of trading on the InvoiceFair platform for 6 months to get access to WIP funding but we assess each company on a case by case basis

Generally, companies are required to create a track record of trading on the InvoiceFair platform for 6 months to get access to WIP funding but we assess each company on a case by case basis

Who provides funding to InvoiceFair?

We are funded by a large hedge fund with over €3bn in assets under management. They have a funding mandates for receivables spread across all of their funds and are a strategic partner for InvoiceFair

How does WIP funding work?

We will allow you to leverage works completed and not yet approved by your debtors (i.e not yet invoiced-Claims Funding) or future works on contracts won up to a certain % of works completed or a monetary value (WIP Funding).

Why choose InvoiceFair?

We are the only True alternative provider of unrestricted growth capital. We partner with ambitious and scaling companies with access to funding at every stage of the credit cycle and allow them to unlock their growth potential.

Have a look at our case studies to see how you could unlock growth capital and fund your future today.

Have a look at our case studies to see how you could unlock growth capital and fund your future today.

How does pricing work?

We like to keep things simple and we don’t want to provide you with any surprises.

We have two simple and clear fees:

1. The discount fee-what the cost of finance will be based on your average drawn balance over a 12 month period.

2. Monthly transaction fee-this is a set fee based at a % of your approved limit on a monthly basis.

We have two simple and clear fees:

1. The discount fee-what the cost of finance will be based on your average drawn balance over a 12 month period.

2. Monthly transaction fee-this is a set fee based at a % of your approved limit on a monthly basis.

Fund your own future today

Unlike most Invoice Discounting solutions, we have a very simple pricing model, with only two components – the discount agreed with the funder and our monthly fee. No sneaky added fees, no minimum contract periods, no concentration limits. See how it could work for you!